By Mónica A. Altamirano de Jong, Founder ALTAMIRA Regenerative Finance

What happens when you bring together urban planners, municipal leaders, climate finance experts, early academics, and nature-based entrepreneurs all under one roof for three days?

You get an intense, cross-disciplinary learning lab that accelerates the shift from planning to implementation of Nature-based Solutions (NbS) and helps cities build the next generation of investable, resilient infrastructure.

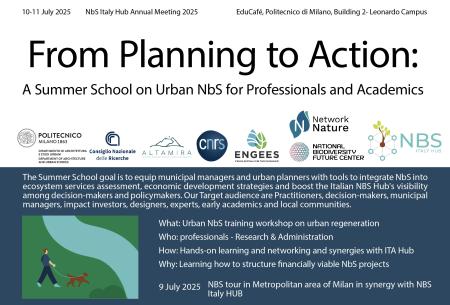

This is exactly what happened from 9–11 July 2025 at Politecnico di Milano, during the first NetworkNature Bootcamp. Hosted as a summer school format titled “From Planning to Action”, the event was co-organised by Politecnico di Milano (DAStU), CNR-IRET, ALTAMIRA and CNRS/LIVE–ENGEES, with support from NetworkNature, the NbS Italy Hub, and the National Biodiversity Future Center.

The initiative emerged from a 2024 call for collaborative proposals and was selected for its potential to activate synergies across multiple Taskforces (TF2, TF3, TF6), particularly around building capacity for local and regional governments (LRGs) to plan, structure, and finance transformational NbS investments through public-private partnership models.

Why This Bootcamp and Why Now?

Despite increasing policy support and growing evidence of impact, most NbS remain underfunded and under-implemented. Cities and public agencies often struggle to develop robust investment cases, align institutional roles, or connect with the private sector in a meaningful way.

The goal of this bootcamp was to close the implementation gap by giving municipal professionals, planners, and emerging experts hands-on experience in designing mission-driven investment pipelines for NbS.

And it worked. Over three days, 32 participants from 14 nationalities came together to experiment with system thinking tools, simulate real project portfolios, and learn how to turn scattered NbS ideas into investable hybrid infrastructure clusters.

Bootcamp Design: Three Days, Full Cycle

Day 1 – Field Visit: The bootcamp began with a technical tour of NbS and Sustainable Urban Drainage Systems (SUDS) in the Metropolitan City of Milan, meeting with local practitioners and seeing how ecosystem services and urban co-benefits play out on the ground.

Day 2 – Strategic Framing: participants were introduced to the Financing Framework for Water Security (FFWS) and Handbook for the Implementation of Nature-based Solutions. Through exercises like Theory of Change mapping, clustering of measures, and analysis of functions and levels of service, teams learned to reframe individual interventions into system-level investment opportunities.

Day 3 – Governance and Financing: The final day zoomed into the financial, commercial, and management dimensions of the investment case. Participants worked on designing funding strategies, identifying appropriate revenue streams, and co-creating collaborative governance models. A final round of presentations and peer feedback brought everything together.

Key takeaways for the structuring of transformational and financially viable NbS projects

The bootcamp surfaced a rich set of lessons on how to design viable NbS financing strategies. Some highlights include:

- Theory of Change first: Strong investment cases begin with strategic clarity. Participants learned to “zoom out” before zooming in, clarifying not only what needs funding, but why it matters and what change it enables.

- Cluster the measures: Moving from isolated interventions to hybrid infrastructure project clusters helps improve risk profiles, cash flows, and makes proposals more compelling to funders.

- Four structuring steps: Mode of governance, funding strategy, financing strategy, and procurement must all align. This framing helped participants map who does what, how money flows, and who takes on delivery responsibility.

- Funding ≠ Financing: Many struggled initially with this distinction, but exercises helped clarify it. Financing is about mobilizing capital upfront for implementation; funding is about who ultimately pays.

- Economic goods shape finance logic: The same NbS asset can produce both public and private goods, meaning mixed financing strategies are often needed.

- Early risk reduction is key: Even strong strategic cases may not be commercially viable without addressing revenue models and perceived delivery risks.

- Blended finance works but needs orchestration: Successful blending requires more than financial tools; it depends on coordination platforms, institutional champions, and shared accountability.

- Private sector ≠ just funders: They can be service providers, off-takers, or asset managers. Mechanisms like carbon credits or land value capture can enable participation without privatizing public services.

Reflections on Format: Summer School as Bootcamp Delivery

Originally imagined as a bootcamp for city practitioners, the event attracted a broader mix of participants, including technical experts, early-career academics, and NbS entrepreneurs, many already working with municipalities in different capacities. Far from diluting the experience, this diversity strengthened the learning environment, allowing for intensive peer exchange and less reliance on facilitators.

This format offers a viable delivery model for future bootcamps, particularly when the goal is to shape the thinking and capabilities of the next generation of infrastructure professionals, while also weaving networks of practitioners who can support LRGs directly.

What’s Next?

Based on the success of this pilot, more bootcamps are coming soon. Between early 2026 and 2027, NetworkNature will be launching a new round of bootcamps designed to support cities in building transformational NbS investment pipelines.

We’re now looking for municipalities, regional agencies, local planners, and Universities interested in hosting or participating in upcoming bootcamps. If you are interested contact us.